AI Driving Chip Recovery in 2024: Navigating Uncertainties

2024 is shaping up to be a strong year, with SIA’s World Semiconductor Trade Statistics forecasting global chip sales to reach $588 billion. CEO John Neuffer believes these figures show that the global chip market is continuing to strengthen.

Much of this growth is due to cloud service providers investing heavily in AI capabilities, which require a lot of processing power. Major players like AWS and Microsoft Azure are turning to NVIDIA for advanced GPU to power their operations.

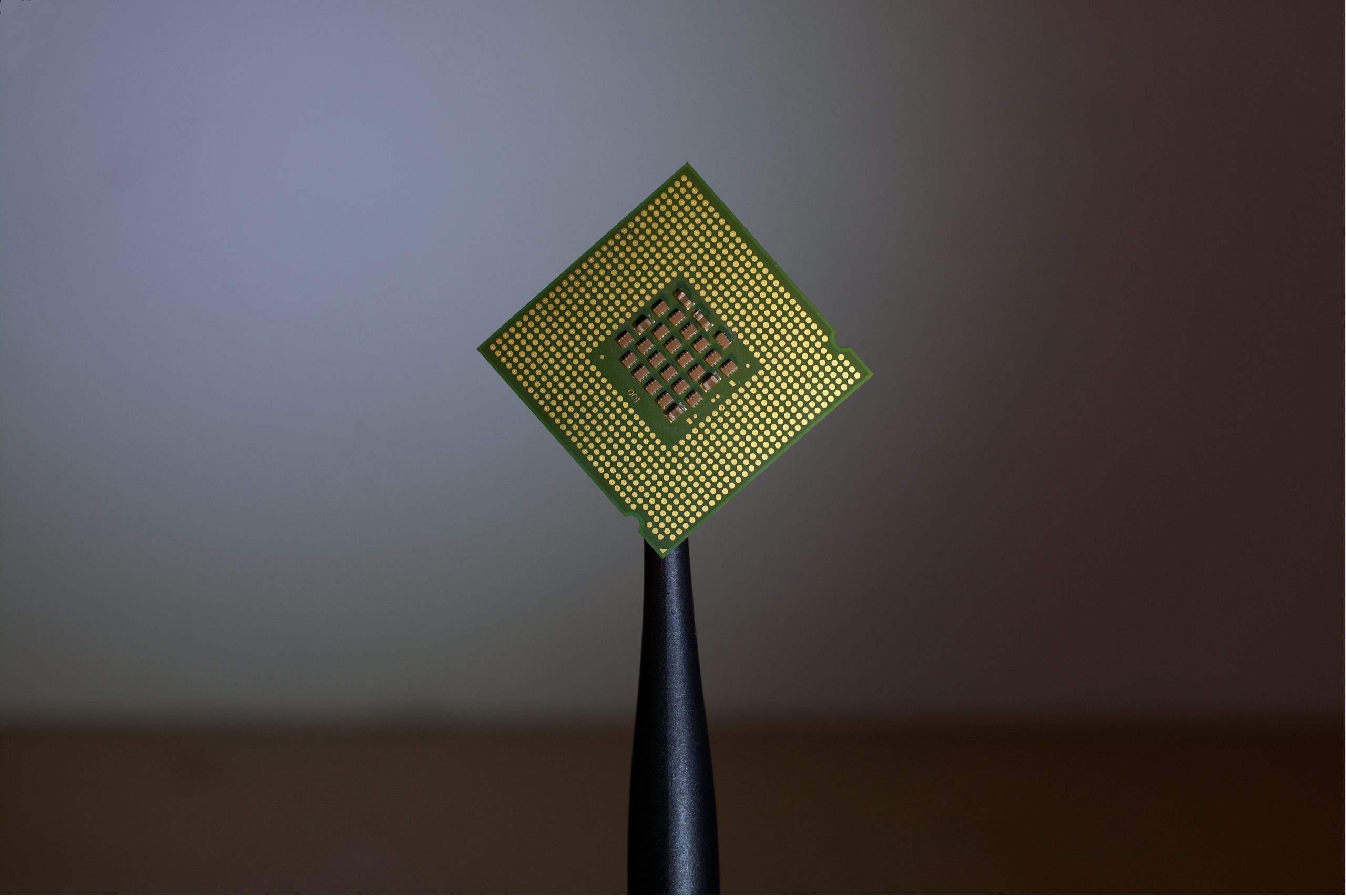

High bandwidth memory (HBM) and fast DDR5 DRAM chips are also in high demand for similar reasons. South Korean chipmakers Samsung and SK Hynix have reconsidered plans to implement production cuts in the second half of 2023. in a recent interview, SK Hynix chief executive officer Kwok Ru-jong said the company was considering a change in its strategy for first-quarter cuts because of signs of improvement in the DRAM market.

While the share prices of many of the world’s top chip companies are soaring in 2023, experts warn against being overly optimistic about growth expectations for 2024. Geoff Blaber, an analyst at CCS Insight, told the Financial Times: “Overall, we’re definitely at a turning point. But we need to stay realistic: without the advantages of high-performance computing, we wouldn’t be talking so positively about an upturn in the semiconductor industry.

For the rest of the market, experts are not optimistic. While AI chips sell for tens of thousands of dollars, they are traded in small volumes. Unlike smartphone or laptop chips, this segment feels somewhat volatile as a driver of growth in the semiconductor industry. However, if the AI boom continues, chipmakers are sure to rise to the challenge for as long as possible.

#laptopchips #smartphonechips #memory #DDR5DRAM #Semiconductor

2024-01-27

2024-01-27